The Hidden Connection Between Proper Tax Preparation and Qualifying for a Mortgage

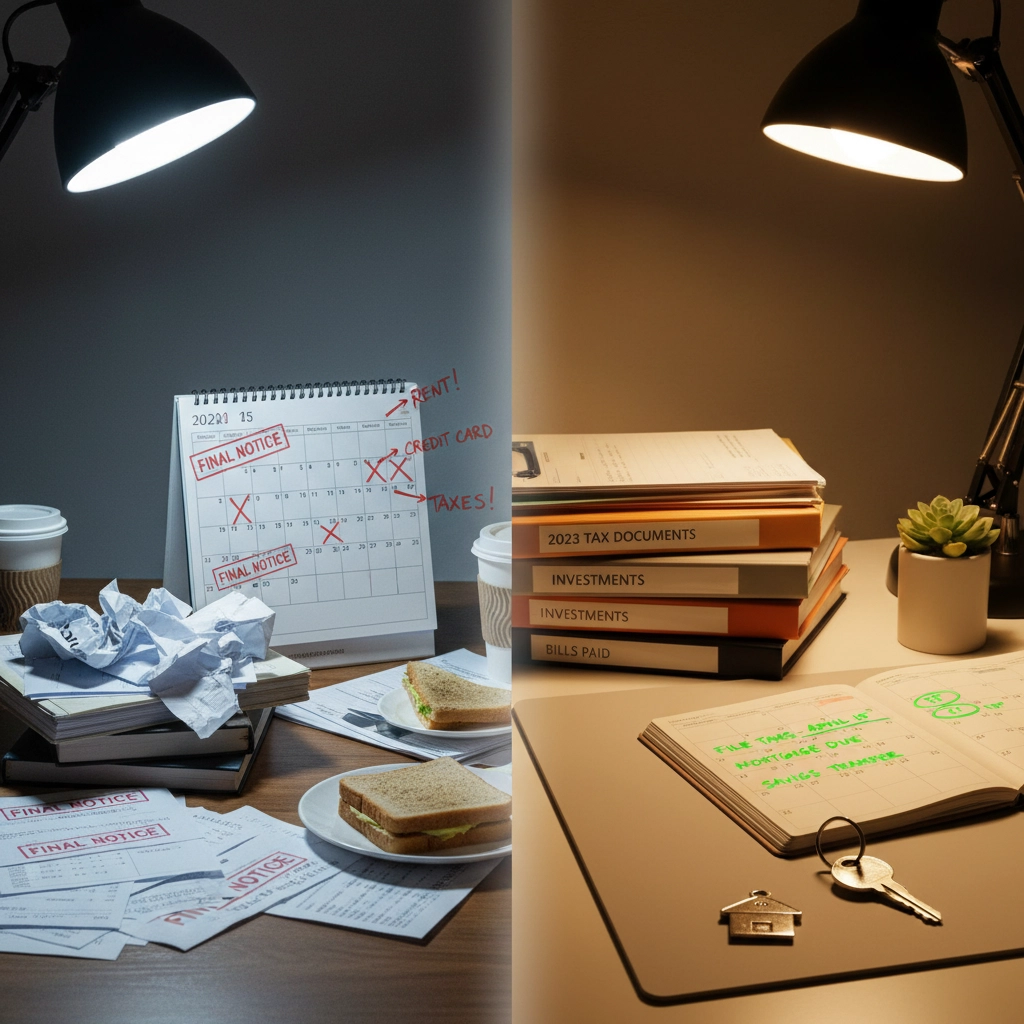

When most people think about getting a mortgage, they focus on saving for a down payment, checking their credit score, or shopping for the best interest rates. But here's something that might surprise you: how you handle your tax preparation can make or break your mortgage application.

Your tax returns aren't just paperwork you file once a year and forget about. They're actually one of the most important documents lenders use to decide whether you qualify for a mortgage and how much they're willing to lend you. The way you prepare and file your taxes can either open doors to your dream home or slam them shut.

Why Your Tax Returns Are Gold to Mortgage Lenders

Think of your tax returns as your financial report card. When you apply for a mortgage, lenders need rock-solid proof that you can afford the monthly payments. While pay stubs show your recent income, tax returns tell the full story of your financial life over the past one to two years.

Lenders love tax returns because they're official documents that have been reviewed by the IRS. This makes them far more trustworthy than other income documentation. Your tax returns show not just how much you made, but also how consistently you've earned income, what deductions you've claimed, and whether you've been responsible about filing on time.

Here's where it gets interesting: lenders use your tax returns to calculate your debt-to-income (DTI) ratio, which is basically the percentage of your monthly income that goes toward paying debts. This ratio is crucial because it determines not just whether you'll get approved, but also how much house you can afford.

How Your Tax Filing Habits Impact Your Mortgage Chances

Timing Is Everything

Filing your taxes late might seem like no big deal, but mortgage lenders see it differently. When they spot a pattern of late filings, red flags start waving. Late filing suggests you might struggle with financial responsibility, which makes lenders nervous about trusting you with hundreds of thousands of dollars.

On the flip side, consistently filing on time demonstrates reliability and financial discipline – exactly what lenders want to see in a borrower.

Consistency Counts

Lenders are looking for stable, predictable income. If your tax returns show wild income swings from year to year without a good explanation, it can complicate your application. This doesn't mean your income has to be identical each year, but dramatic changes will require additional documentation and explanation.

Accuracy Matters More Than You Think

Any discrepancies between your tax returns and other income documents will slow down your application. If your W-2 shows one income amount but your tax return shows something different, you'll need to explain the difference. Even small inconsistencies can lead to delays and additional verification requirements.

Different Rules for Different Employment Types

Traditional W-2 Employees Have It Easier

If you're a salaried employee with a W-2, you're in the sweet spot for mortgage qualification. Most lenders will want to see two years of personal tax returns, along with your most recent pay stubs. Some streamlined programs might only require one year of tax returns if your income is stable and well-documented.

The process is relatively straightforward because your income is predictable and easy to verify. Lenders can quickly see your salary history and feel confident about your ability to make consistent mortgage payments.

Self-Employed Borrowers Face Higher Hurdles

Being self-employed makes the mortgage process more complex, and your tax preparation becomes even more critical. Lenders typically require at least two years of consistent self-employment in the same industry, along with extensive documentation including:

- Two years of personal tax returns (Form 1040) with all relevant schedules

- Two years of business tax returns with appropriate schedules

- Current profit and loss statements

- Business licenses and other proof of employment history

Here's where tax preparation strategy becomes crucial for self-employed borrowers: those aggressive deductions you use to minimize your tax bill can actually hurt your mortgage qualification. Lenders may add back certain business expenses when calculating your qualifying income, but some deductions permanently reduce the income they'll consider.

For example, if you write off a home office, vehicle expenses, or business meals, these deductions lower your taxable income. While that's great for reducing your tax bill, it also reduces the income lenders will count toward your mortgage qualification.

Real Estate Investors Need Extra Documentation

If you own rental properties, you'll need to provide Schedule E forms showing your rental income and expenses for the past two years. Lenders will analyze your rental income carefully, often applying a vacancy factor to account for potential periods without tenants.

The Tax Debt Trap

Outstanding tax debts can be mortgage killers. Some loan programs will automatically disqualify you if you owe back taxes to the IRS. Even if you've arranged a payment plan, those monthly payments will be factored into your debt-to-income ratio, potentially reducing the amount you can borrow.

This makes staying current on your tax obligations crucial not just for avoiding IRS troubles, but for maintaining your ability to qualify for a mortgage when you're ready to buy.

Smart Tax Strategies for Future Homebuyers

Plan Ahead

If you're thinking about buying a home in the next few years, consider how your tax preparation decisions today will impact your mortgage application tomorrow. This doesn't mean you should overpay your taxes, but it does mean thinking strategically about timing major deductions or business structure changes.

Keep Meticulous Records

Whether you're self-employed or a W-2 employee, maintain detailed records of all income and deductions. Lenders will scrutinize your tax returns carefully, and having documentation to back up every line item will smooth the mortgage process.

Consider Professional Help

Working with a tax professional who understands mortgage lending requirements can help you optimize your tax strategy without compromising your borrowing capacity. They can help you balance tax savings with mortgage qualification needs.

Time Your Tax Moves Carefully

Avoid making major changes to your tax situation in the year before applying for a mortgage. This includes changing business structures, claiming unusually large deductions, or making significant changes to how you report income.

The Bottom Line: Your Tax Returns Tell Your Financial Story

The connection between tax preparation and mortgage qualification comes down to one simple concept: trust. Lenders use your tax history as evidence of your financial responsibility, income stability, and ability to manage money effectively.

By maintaining clean, consistent, and timely tax filings, you're not just staying compliant with the IRS – you're building a financial profile that mortgage lenders will find attractive. Your tax returns become a powerful tool that demonstrates you're a low-risk borrower worthy of the loan amount you're seeking.

Remember, buying a home is likely the largest financial transaction of your life. Taking a strategic approach to tax preparation – one that considers both tax optimization and mortgage qualification – can save you thousands of dollars and help you achieve your homeownership goals more quickly.

The next time you're preparing your taxes, think beyond just this year's tax bill. Consider how your filing decisions today will impact your mortgage application tomorrow. With proper planning and preparation, your tax returns can become your secret weapon in the mortgage qualification process.